Tax Planning

I. Utilize Tax-free Investment Vehicles

II. Maximize Retirement Savings Opportunities

III. Charitable Planning

IV. Wealth Transfer Beyond Estate Tax

V. Qualified Long Term Care Premium Deduction

VI. Children and Education Tax Credits

VII. Business Deductions

Not only is the tax law more complex than what most Americans would like to deal with, it is ever changing according to the politics of the day.

Despite the complexity, an American taxpayer essentially needs to deal with three types of taxes: income tax, capital gains tax, and estate tax. Since estate tax now applies to only a few taxpayers with large estates that exceed over $22 million, we will address only income tax and capital gains tax, which is part of income tax, that concern most Americans.

Strategies to reduce income tax liabilities.

I. Utilize tax-free investment vehicles.

Under the tax law, there are only 3 investment vehicles that offer tax-free income: Roth IRA, municipal bonds , and cash value life insurance.

- Roth IRAs

Roth IRAs are funded with after-tax dollars, but the growth is forever tax free. It is more tax efficient than regular IRAs or 401(k)s, which are only tax-deferred as the distributions from these accounts are 100% taxable. Though you pay taxes up front, but the tax amount is lower than taxes paid on deferral basis. For example, if a Roth account begins with $10,000 and the tax liability is 20%, then the upfront tax amount is $2000. In 20 years, if the $10,000 grows to $50,000, there will be $0 tax for any withdrawal. In contrast, for a regular IRA, the tax liability is $0 at the beginning, but it will be $10,000 (20% of $50,000) when money is taken out of the account. This ‘tax now’ versus ‘tax later’ is often referred to taxing the seed versus taxing the harvest.

- Municipal Bonds

There are many types of muni bonds. Some are taxable if you are subject to the alternative minimum tax, but the ones that are tax exempt are generally known as general obligation bonds issued by states and municipalities. They usually pay less interests than other types of bonds such as corporate bonds. But because of their tax exemption, they can be very competitive and are relatively safe.

- Cash Value Life Insurance

Cash value life insurance is a savings vehicle that is highly tax friendly, as any growth within a policy is tax free, and any withdrawal is also tax-free. Accordingly, cash value life insurance can be effectively used as a wealth building vehicle. However, using such life insurance is a long term commitment, as it usually takes about 10 years for the benefits to accrue. As a savings vehicle, such life insurance can yield a return of around 5-6% tax free.

Many people consider cash value life insurance expensive, as compared with term insurance. Plenaris Advisory® published a position paper that shows that such life insurance is far from expensive, as its benefits exceed comparable investment that is subject to tax. Click here for the position paper.

- Health Savings Account (HSA)

In addition to the three tax-free investment vehicles listed above, a health savings account is a new tax-free vehicle to save for medical expenses. It is known to be triple tax-advantaged because the contributions are tax deductible, the account growth is tax-free, and the withdrawal is also tax free. You or your employer can contribute to the account, which can accumulate indefinitely until you withdraw funds from it for medical expenses. The only caveat for the account is that you must have a high deductible health plan, which is determined by the IRS to be $1350 for an individual, and $2700 for a family in 2019. For 2020, the high deductible limit will increase to $1400 for an individual and $2800 for a family.

Contributions to HAS will also increase from 2019 to 2020. The maximum contribution for an individual is $3500 in 2019 and $3550 in 2020. For families, the maximum contribution is $7000 in 2019 and $7100 in 2020.

Given the tax advantage, it is advisable to open an HSA as part of your long term savings plan.

II. Maximize Retirement Savings Opportunities

Despite the fact that savings in tax-deferred vehicles such as IRAs and 401(k)s will be subject to income tax at withdrawal, it is still advisable to save as much as possible in these plans, as your tax liability in retirement may be lower than when you are still working. In 2019, the maximum contribution to employer plans such as 401(k) is $19,000, and $25,000 for employees 50 years old and over. For people who have a late start on retirement savings, such maximum contribution, which is indexed to increase every year, can significantly boost their retirement savings while reducing their current income taxes.

While Roth IRA is one of the best tax-free savings vehicles, it is not available to those who have high income. However, Roth conversion is available to everyone with no income limits. The strategy then is to load up on plans like 401(k) for the possibility of converting the savings into Roth whenever there is a tax benefit to do so.

For a list of retirement plans and their characteristics, please go to the Resource page for retirement articles.

III. Charitable Planning

- Qualified charitable distribution QCD

Qualified charitable distribution refers to making contributions to charities directly from one’s IRA or other qualified retirement accounts when one is subject to the required minimum distribution (RMD) after 70½. The QCD would reduce the RMD and ensures that the charitable contributions count as a tax credit. This is a tax-efficient way to make charitable contributions when the current standard deduction and limited itemized deductions make it difficult for many taxpayers to make charitable donations in the traditional way.

It must be noted that the QCD is limited to $100,000 per year, and that only the first distribution from a qualified retirement account every year can be credited to charitable contribution. The contribution can only be directly transferred from the retirement account custodian to the charity, and there should be NO quid pro quo gifts from the charity to the donor in any form, which would invalidate the donation.

- Charitable gift annuity

Besides the qualified charitable distribution from retirement accounts, there are many ways a taxpayer can make deductible charitable donations under the tax law, such as charitable annuity trusts, charitable lead trusts, donor-advised funds, charitable foundations, direct cash and property gifts. However, a charitable gift annuity is one of the simplest ways to make a charitable donation while retaining an income for life. It is a win-win solution for people who wish to use their savings to donate to their favorite charity, but need some income from the same savings for their livelihood. A charitable gift annuity is therefore a vehicle that allows the donor and the charity to share the benefits of the gift. The following is an explanation of how it works.

How does it work?

Many large non-profit organizations, including many universities and colleges, offer charitable gift annuities. A donor would select the non-profit entity and make a single donation. The entity would manage the donation and gives the donor an annuity income for life, either as single or joint life with another individual. When the annuitant dies, the non-profit entity would receive the remainder of the gift. In effect, instead of an insurance company benefitting from any remaining interests in an annuity, the non-profit entity would be the beneficiary of the remaining interest in a gift annuity.

During his lifetime, the donor would receive tax-free benefits for part of the annuity payment. The American Council on Gift Annuities sets up the rules on how much each charity can offer for annuity payments, which are usually determined by the donor’s age and market conditions. The IRS then determines the rules on how much income tax deduction can be applied to each annuity payment, which are usually based on the life expectancy of the donor by age and gender.

What are the tax benefits?

There are two tax benefits when a donor makes a contribution under the IRS rules. The first benefit applies when the donor can take an immediate deduction at the time of donation. For example, for a donor age 65, who makes a $100,000 cash donation, he can immediately deduct $28,567 from his income tax return for the year of donation. When he receives an annuity payment, a significant portion of his payment, which can be as much as 93%, can be tax-free during his lifetime up to his life expectancy as determined by IRS.

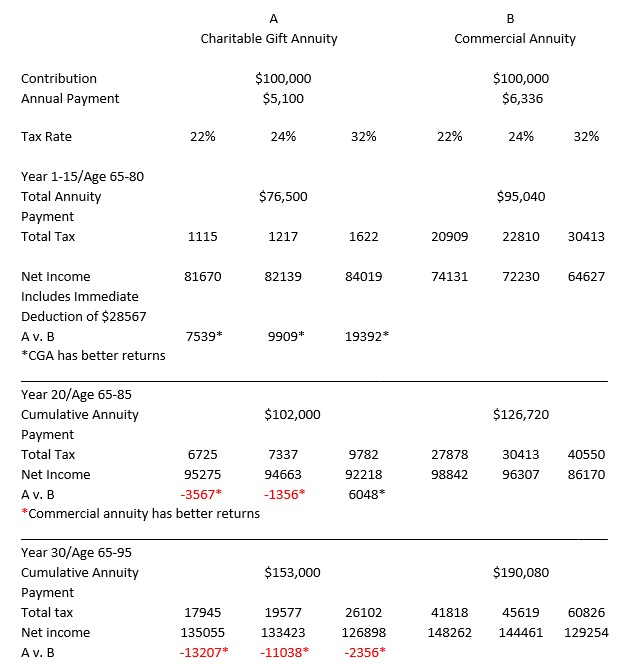

Here is an illustration of how a charitable gift annuity works in comparison to an immediate annuity which also provides lifetime income to a donor. Note that this is only an illustration of the concept of how a gift annuity works. It does not take into account many tax issues that may apply to a donor. Additionally, the numbers can change because the annuity payments can vary among charitable organizations.

The illustration is based on the following assumptions.

- The donor is a 65 year old male.

- He makes a $100,000 donation to a charity for an annuity payment that begins immediately.

- Under the American Council annuity schedule, the current maximum payment for a lifetime annuity is 5.1%, which translates to $5100 annual payment on the $100,000 contribution.

- Under the IRS rules on gift annuity, the donor can deduct $28,567 immediately as charitable contribution from his income tax return.

- The donor will also be able to have a tax-free income for 15 years according to the IRS life expectancy schedule, which amounts to $4762 of the $5100 annual annuity payment.

- It means that the donor will only have to pay income tax on $338 of the income from the annuity each year for 15 years.

- If the donor lives beyond the 15 year life expectancy, the tax-free benefit will terminate and he will henceforth be liable for ordinary income tax for the entire $5100 annual payment.

The chart below demonstrates the income and tax benefits of a charitable gift annuity versus a regular or commercial immediate annuity for comparison purposes.

What we can learn from the data in the chart.

- Compared with a regular commercial immediate annuity, a CGA will receive less annuity payment, $5100 versus $6336 annually.

- Within the life expectancy time frame of 15 years, the net returns of a CGA are actually better than a regular annuity because of the tax benefits.

- The higher the tax rate, the better the benefits from a CGA.

- The tax benefits are front loaded at the inception of the donation where the immediate tax deduction can offset other incomes of the donor.

- After the life expectancy, the benefits from a CGA will begin to taper off because the donor will be liable for the entire annuity payout.

- If the donor lives a long time beyond his life expectancy, the charity will experience a loss from the donation because the cumulative annuity payment will exceed the initial donation.

- Due to the lower annuity payment, the donor must have a clear charitable intent to engage in a CGA program. If the donor’s primary concern is income, he should consider other vehicles for higher income, such as a commercial annuity.

Charitable Gift Annuity v. Immediate Annuity

IV. Wealth Transfer Beyond Estate Tax

Though estate tax may not apply to 99% of Americans who do not have an estate of more than $11 - 22 million, there are still some tax issues that need to be considered by most Americans regarding transferring their assets after death that have income and capital gains taxes implications.

- Stepped-up basis of assets.

Stepped-up basis refers to the increased value of an asset at the death of an owner. Generally, if an owner of an asset dies, the value of such asset would include all the growth that has accrued to the asset since acquisition. For example, if a house has appreciated from $100,000 at purchase to $200,000 at death, the basis of the house would be stepped-up to $200,000 for the next owner, who can be the spouse or other beneficiaries. So, when the new owner sells the house for $250,000, the capital gains on the house would only be $50,000, and not $150,000.

Note that the stepped-up basis does not apply to properties owned as joint-tenancy. It also does not apply to married couples if they do not hold the property as community property, in which case only the 50% interest of the deceased spouse would be entitled to the stepped-up basis. It is therefore important for married couples to hold titles to their properties properly in order to enjoy the stepped-up basis under tax law.

- Inheritance versus lifetime gifts.

For stepped-up basis to apply, a property must be passed through inheritance, and not gifting. If a parent should want to gift his home to a child while he is living and transfer the title, or add the child to the title, the basis of the home would remain the original purchase price for the child, even after the parent’s death. While gifting during life is advisable for large estates to reduce estate tax liability, it is often not the best strategy for most Americans whose beneficiaries may incur income tax liability which could be otherwise avoided.

- Passing retirement accounts to beneficiaries.

When 401(k)s, IRAs, and other retirement accounts are passed to beneficiaries at death, the current tax law allows the beneficiaries to stretch out the distribution from such accounts over their lifetime and beyond, which enables such accounts to accumulate tax-free for more than a generation. This is known as ‘stretch IRA.’ However, new tax laws are being proposed to eliminate ‘stretch IRA,’ so that retirement accounts must be totally distributed and taxes paid up within 5 to 10 years. These new laws mean that beneficiaries will have to pay income taxes on their inheritance within 5 or 10 years. If the retirement accounts are large, some of which can be in the millions, beneficiaries will surely have a large income tax liability.

Have you heard of the 75% tax trap?

Though many Americans do not have a federal estate tax issue due to the $11 million+ personal exemption, those that have large estates may encounter the 75% tax trap, which means that you may be subject to 40% estate tax plus 35% income tax on the retirement accounts that you leave to your beneficiaries. So, for a $1 million account, your beneficiaries may end up getting only $250,000.

Additionally, while you may not be subject to federal estate tax, you may be subject to state estate tax. Currently, 18 states have either an estate or inheritance tax that range from12% to 20%. It is critical that you be aware of the various tax obligations of your estate and plan accordingly.

In anticipation of the new laws, Americans with sizable retirement accounts must reconsider what to do about the disposition of these accounts in order not to create a huge tax liability for their families after their death. Plenaris Advisory® can work with you on this issue in order to have some solutions in place through proactive tax planning. Call us at 408-293-1888 for a consultation today.

- Special income tax issues for the surviving spouse.

One issue that faces a surviving spouse is that after the death of a spouse, the income tax liability of the surviving spouse will increase for the same or a less amount of income. The reason is that the tax filing status has changed from married filing jointly to single filing, which leads to a higher bracket for the surviving spouse even if the income is greatly reduced because of the loss of one income. Since the wife is more likely the surviving spouse, a married couple should address this issue to ensure that the surviving spouse will be able to handle her tax obligations on her own.

V. Qualified long term care premium deduction.

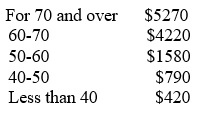

For people who have the traditional type of long term care insurance, the premium for such insurance is deductible if the total medical expense exceeds 10% of adjusted gross income. The amount deductible for 2019 by age is as follows:

These deductions are not available to hybrid type long term care plans that are combined with life insurance or annuities.

VI. Children and education tax credits

The tax code provides for many credits for households with children and their education expenses, which include the following.

- Child tax credit

The child tax credit provides up to $2000 per child and a maximum refundable amount of up to $1400 per household. The credit applies to all children under age 17. The income limit for claiming the credit is $200,000 for single filers and $400,000 for joint filers.

- Dependent credit

Dependent credit is a credit for any dependent of the taxpayer that does not qualify for the child credit. There is no age limit for this credit. The credit is $500 per dependent and is not refundable.

- Child and dependent care credit

This is a credit that applies to 20-35% of child care expenses with a maximum of $3000 per child and a maximum of $6000 for multiple children. There are no income limits on the credit. But the credit is limited to children under age 13. The credit also applies to dependents who are not capable of taking care of themselves regardless of age.

- Earned income tax credit

This tax credit is designed to benefit working people with low incomes. The amount of credit varies by earnings, filing status and the size of the family. For 2019, the maximum credit is $6557 for a family with 3 or more children with the income limit of $50,162 for single filers and $55,952 for joint filers.

The credit is refundable. For example, if the credit is $6557 and the tax liability of the taxpayer is $3000, $3557 of the credit can be refunded to the family.

- American opportunity credit

It is an education credit for the first four years of college. The credit amount is $2500 per student with up to $1000 refundable. The income limits range from $80000 - $90000 for single filers and $160000 - $180000 for joint filers.

- Lifetime learning credit

This is a credit for educational expenses incurred by anyone and is not limited to college. The credit amount is 20% of the first $10000 eligible expenses up to $2000. There is only one credit per household. It is not refundable and a taxpayer cannot claim both the American opportunity credit and the lifetime learning credit for the same student. The income limits for this credit in 2019 range from $58000 - $68000 for single filers and $116000 - $136000 for joint filers.

- Student loan interest tax deduction

If you pay interests on qualified student loans, you can deduct up to $2500 from your taxable income. The income limits for 2019 are $70000 - $85000 for single filers and $140000 - $170000 for joint filers.

- Health insurance for the self-employed

If you are self-employed and have a health plan that includes a child under age 27, you can deduct the premium for the plan that includes the child, even if the child is no longer your dependent.

- Employer education assistance program

If an employer offers an education assistance program as a benefit, an employee can enjoy such benefit up to $5250 as a non-taxable benefit every year.

VII. Business deductions

Unlike employees, business owners can reduce their tax liability in many more ways. For example:

- They can deduct the premium for medical insurance, including Medicare, which reduces their gross income.

- They have more retirement plan options.

- Under Section 179, all qualified business related expenses can be expensed 100% up to $1 million, which include office supplies, equipment, computers, furniture, business vehicles, etc.

- Telephone.

- Mileage.

- Travel and meals.

- Home office use.

- 20% reduction of net income for qualified businesses.

This is an overview of some of the common issues of tax planning. With proper tax planning, anyone can save hundreds and thousands of dollars. Start your tax savings now, and contact Plenaris Advisory® for a review of your tax situation.