Investment Planning

Investment is the cornerstone of wealth creation, as how much wealth you will have depends on how well you invest.

For financial planning purposes, one of the key issues is not how much you have made from investment, but how much you get to keep what you have made, as what you have made may be subject to the risk of loss. The strategy for keeping your wealth is to ensure that you achieve your investment goals with the least risk possible. Accordingly, there are two factors that are critical for keeping your wealth. The first factor is safety, and the second factor is taxation.

- Safety

Safety relates to how risky your investment is.

What are investment risks? The following is a list of investment risks that any investment may be subject to.

- Market risk, which pertains to the volatility of the market and the prevailing economic conditions.

- Business and management risk, which pertains to specific business and its management whose stock you own.

- Interest rate risk, which applies to investments that depend on interest rates, such as bonds.

- Currency risk, which applies to investments in different countries.

- Liquidity risk, which relates to how easily your investment can be turned into cash.

- Concentration risk, which refers to investments that focus on only a few things, rather than broad-based.

- Credit or default risk, which relates to whether the business or the agency that issues debt securities may default on the securities.

- Reinvestment risk, which may occur when new investments that replace the old investments are inferior to the old investments in terms of quality and returns.

- Inflation risk, which reduces the value of your investments due to the loss of purchasing power when the same amount of money will buy fewer goods and service.

- Longevity risk, which relates to the diminishing value of your investments due to the requisite consumption of your investments and savings.

- Political risks which may impact the viability of any investment.

Given all the potential risks associated with investments, do you know the risk score of your investments? To find out, click here.

Did you know that the S&P 500 index has a risk score of 67 and an average return of 5.62% (without dividends) and that the average mutual fund investors averaged only a 3.88% return from 1998 to 2018? (Data source: 2019 DALBAR Report.)

So, in addition to all the risks identified above, investor risk is yet another risk that would impact the result of any investment. Why is there such a wide discrepancy between market return and investor return? The annual DALBAR report consistently finds that investor behavior is the reason for achieving lower returns than the market.

If you want to know what your own risk score is, click here.

How to manage investment risks?

Here are a few strategies to manage investment risks.

Diversification. Diversification relates to spreading your investment money over many classes of assets instead of only a few. The idea is not to put all your eggs in one basket. The asset classes include stocks, bonds, commodities such as gold, real estate, cash, and subclasses in stocks such as large cap, small cap, growth, value, and income equities. The objective of diversification is to reduce the risk of loss as different assets are expected to perform differently in different market environment so that not all investments will encounter the same conditions at the same time.

Asset allocation. Asset allocation concerns the amount of resources you should put in any one particular asset. For example, if you invest in 10 different assets, you should put no more than 10% of your money in each asset as an equal weight strategy. Or, you can put varying amount of money in each asset by overweighting some and underweighting others. The allocation mix is usually dependent on your financial goal. A common practice is to allocate more money to bonds during retirement when income is needed over the growth of stocks.

Dollar cost averaging. It is a strategy to accommodate the volatility of the market where asset prices go up and down, and buying stocks and bonds in smaller increments will help reduce the overall cost and the overall risk as well.

Be realistic with returns. As it is an investment adage that high rewards usually require high risks, one way to manage risk is to understand the risk profile of each investment and the corresponding returns. It takes due diligence and research to assess the risk of each investment before making any investment decision.

Have a long investment horizon. A long term investment usually offers a higher probability of maximizing your return over a 10-year or longer period, as the market is cyclical, and a downturn can usually recover within a short time. For example, it was noted that since 1950, the S&P 500 has experienced 13 downturns in the range of 10-20%, and the average trading days to recovery is 71. (Delta Investment Management newsletter April 12, 2019.) It is therefore important to have a long term perspective on investment as a way to manage short term volatility in the market.

Keep track of investments. One sure way to manage investment risk is to keep track of your investment portfolio. Not only do you need to follow the performance of your investments, you also need to know whether your investments are meeting your financial goals. If your goals are not being met, then you need to make adjustments to your portfolio.

There are other strategies to manage risk, which include option writing, leverage, hedging , long/short and alternative investment, etc. Some of these strategies carry their own risks and can incur higher costs with no clear benefits for the average investor.

- Taxation of investments.

Taxation is the second factor that affects how much of your investments you get to keep.

All investment incomes are subject to tax, either as income tax or capital gains tax. However, our tax system has established three levels of investment income: taxable income, tax-deferred income, and tax-free income.

Taxable incomes are incomes that come from investments, like interests, dividends, and rents. Tax-deferred incomes are incomes that come from retirement savings accounts, such as 401(k), and IRA, which are not taxed until they are distributed in retirement. Tax-free incomes are from a special class of investments that are limited to only three types of investments: Roth IRAs, municipal bonds, and cash value permanent life insurance. As taxable incomes are subject to tax rates that currently range from 10% to 37%, it is clear that taxable investments will result in lower wealth after the taxation of investment gains.

Given that both Roth IRA and muni bonds are still subject to market risks, cash value life insurance is about the only tax-free investment option that may be relatively safe from all the identified investment risks.

Is cash value life insurance both safe and tax-free?

Why is it safe?

It is safe because it is not subject to market risks. While there are products that are based on market performance, such as variable life, many cash value permanent life policies, such as fixed index universal life (IUL) and whole life are based on more than market performance, as they offer downside protection by maintaining the current value of a policy in a down market.

It is also safe because it offers investment diversification from market-based investments such as stocks and bonds.

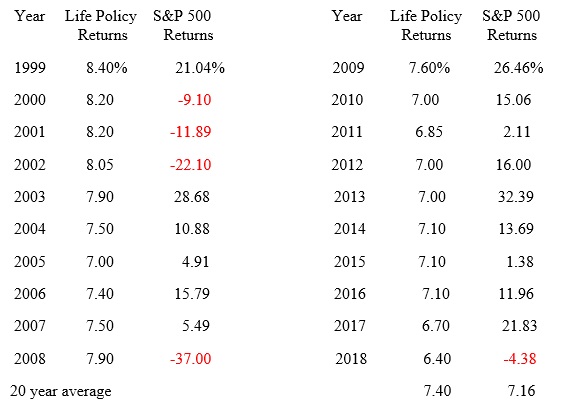

In fact, cash value life insurance can have a better return long term than stocks as the following chart shows that the average return from a cash value whole life policy for the past 20 years, 1999-2018, was higher than the returns from S&P 500. Note that the data for the whole life policy are based on one of the top insurance companies and are shown as a sample illustration, and do not in effect represent the entire universe of cash value life insurance. The S&P 500 return data include dividends.

Returns of a Sample Whole Life Policy and the S&P 500, 1999-2018

The data above serve to support the safety and the low risk aspect of cash value life insurance:

- There was never a down year, whereas the equity returns registered 5 losses.

- Note that in 2008 when the equity market was down 37%, the life policy maintained a positive return.

- The returns for the life policy were steady from year to year without wide swings, whereas the equity returns tended to be volatile with significant ups and downs from year to year.

- The cash value life policy offers good protection against investment loss.

- The life policy offers more predictable returns than equity.

- It must be noted that the return of a cash value life policy applies only to the cash value after accounting for the cost and the fees for the policy, while the return on the S&P 500 as shown on the chart is before applicable fees which may reduce the actual return of any investment in the index.

- If taxes apply to the equity returns, the 7.16% average returns would be reduced according to the applicable tax rates.

Besides being a low risk investment, a life policy also offers creditor’s protection in some states that helps to preserve wealth.

Why is it tax-free?

A life policy is tax-free for the following reasons.

- The death benefit is tax free under the tax code.

- If you take money out of the cash value of a life policy, it is considered a withdrawal or a return of your premium payment, and thus not taxable.

- If you take money out of the cash value of a life policy in the form of a loan, it is also not considered income, and thus not taxable.

However, a life policy can be subject to tax if it is overfunded, as it may be characterized by IRS as a MEC, a modified endowment contract. It is therefore important that a policy be designed to avoid being characterized as a MEC. Taxes may also apply if withdrawals exceed the total premium paid into the policy.

For investment planning, it is important to go beyond the traditional avenues such as stocks and bonds, and to make sure that your investments be safe from loss due to either market forces or taxation.

Just because cash value life insurance is a good investment vehicle does not mean that one should use it exclusively for wealth building, and an investor must fully understand how a policy works long term. It must be noted that cash value life insurance is an insurance product, which requires a long term investment horizon for the best benefits, as the cost structure can incur a loss during the first 10 years of the policy. Plenaris Advisory advocates a multi-asset, diversified approach that maximizes the growth potential of your investments while minimizing your tax liability. Please contact us at plenarisadvisory@gmail.com, so that we may work with you to construct an investment portfolio for all seasons.