Money Management

- Know your numbers

- Set your money goals

- Understand the time value of money

- Debt elimination

- Mortgage loans

- Tried and true good money practices

- Know Your Numbers

Money management is what you do every day with your money. Yet, did you know what is the most important thing about money management? It is KNOW YOUR NUMBERS.

- Do you know what you are bringing home as income?

- Do you know what and how much you are paying for all your expenses?

- Do you know what your taxes are?

- Do you know what your debts are, including credit card debt, student loan debt, car loan, mortgage, etc.?

- Do you know if you are overspending?

- Do you know if you can save some money from your income after paying all your expenses?

- Do you know what kind of savings benefits your employer offers?

- Do you know how much you are saving if you participate in your employer’s retirement plan?

The answers to these questions are fundamental to managing your money. Once you know the answers, you will have a good picture of your finances that will lead to the next step of financial planning, which is to organize your money, determine your financial goals, and develop ways to achieve your goals.

- Set Your Money Goals

Once you have a good grasp of your numbers, the second most important thing about money management is to set goals so that you are in command of every dollar you have. While everyone may have different goals, there are three broad goals as a rule of thumb that can help you start setting your own goals.

The three main goals are often known as 50/30/20.

- 50 stands for 50%, which represents your essential expenses, which may include:

- Housing – rent or mortgage payment

- Food – groceries, take-out meals

- Utilities – power, water, garbage

- Transportation – car payment, insurance, parking, commute, gas, repair, license

- Communications – internet, cell phone

- Grooming – laundry, haircuts, uniform

- Medicine

- Professional licenses

- Insurance premiums for health, life, renter’s, homeowner’s, and other insurance

- Property taxes if you own your home

- Child care, if applicable

- Home maintenance, yard care

- 30 stands for 30%, which represents your ‘wants’ or discretionary expenses, such as:

- Coffee shops – Starbuck, Jamba Juice

- Dining out – restaurants, bars

- Fast foods – pizzas

- Movies

- Music

- Netflix

- Concerts

- Wardrobe

- Pets – veterinarian visits

- Gifts

- Charitable donations

- Gym membership

- Hobbies

- Travels for short trips

- 20 stands for 20%, which represents your financial goals and obligations, such as:

- Credit card payment

- Student loan payment

- Emergency savings

- Retirement savings

- Down payment savings for home purchase

- New car savings

These are broad categories of spending items that you can incorporate into your money goals. If you find yourself spending less on the 50% essentials or the 30% discretionary expenses, you can transfer the excess to the 20% savings goal, or pay down your debt. As a matter of good practice, you should pay off all credit card expenses in each monthly statement without carrying a balance. In fact, your credit card charges should have been accounted for in the 50% category if you use your card to pay for the essentials. One of your goals may be to reverse the money allocation for 30% and 20% by saving 30% of your income, and spending no more than 20% on discretionary items.

Note that these are basic items for your money goals. Other money goals may include wedding savings, or even savings for a boat that you may have wanted for a long time. These are usually one-time goals, but should be planned for in order not to use credit card for these purposes.

- Understand the Time Value of Money

One of the key principles about money management is the time value of money. It means that money can multiply itself over time. For example, if you put away $5000 today and it grows at 7% per year, in 20 years, it will become $19,348; in 25 years, $27,137; in 30 years, $38,061; in 35 years, $53,383; in 40 years, $74,872, and so on.

This growth of money is known as the ‘magic of compounding.’ So, if anyone would begin his savings regime at a young age, such as 25, he will get $74,872 in 40 years at age 65 from $5000. If another person does not begin savings until age 45, he will get only $19,348 at age 65 after 20 years, which is only a fraction (26%) of what he would have gotten if he had saved earlier.

The compound impact of money is usually referred to as the ‘rule of 72.’ The rule is used to estimate quickly how long it will take for an investment to double based on a given interest rate. For example, if you invest $1000 and the return is 10%, your investment will double in 7.2 years, or 72 ÷ 10. If the return is 9%, your investment will double in 8 years, or 72 ÷ 9. If the return is 8%, your investment will double in 9 years, or 72÷ 8.

- Eliminate Debts

Debts can be overwhelming, particularly debts that are relatively large compared to one’s income. Debts can have a deleterious effect on one’s emotional wellbeing. Studies have found that people who struggle to pay off their debts and loans are more than twice as likely to experience a host of mental health problems, including depression and severe anxiety.

It is therefore advisable to eliminate one’s debts as soon as possible. Here are some practical tips that help eliminate debts.

- Know to whom and how much you owe.

- Know the details about how much you need to pay back: the payment schedule, what date of the month the payment is due, the interest charged, the late fee amount, etc.

- Create a payment calendar, so you do not miss a payment.

- Make at least the minimum payment on all debts.

- Prioritize your debt according to interest rates or loan size. Pay the loan with the highest interest rate first or with the highest amount.

- Use the debt snowball method to accelerate payment. This strategy entails lining up all debts according to the size with the smallest amount at the top, and the largest amount at the bottom. Pay off the smallest loan as soon as possible with excess cash, then apply that payment to the next loan in line, and so on. This strategy would accelerate the payoff of all the debts one by one.

- Do not take out another loan when engaging in paying off all the debts.

- If you have credit card debts, check your credit card statements assiduously to make sure that all payments are received and registered.

- Check your credit report also to make sure that the record is correct.

There are also additional ways to accelerate debt payment, which require more commitment on your part, and which include:

- Pay more than the minimum amount.

- Reduce spending and put all spare cash to paying down the debts.

- Sell everything that you don’t need to raise cash.

- Earn more money through a side hustle, or pick up a seasonal part-time job.

- Check your credit score to negotiate a lower interest rate on credit card debts.

- Consult a debt counselor or financial planner to develop a debt repayment plan that would facilitate the elimination of your current debt as well as the avoidance of future debts.

For student loans, which are a special type of debt, there are additional strategies that you may need to consider, as there are many ways to pay back the loans. Depending on the type of student loans that have been taken out, borrowers may elect to have income-based repayment (IBR), pay as you earn (PAYE), revised pay as you earn (REPAYE), and income contingent repayment (ICR), which all have different repayment amounts and schedules. Additionally, borrowers may consider the public service loan forgiveness program by working for government entities or non-profit organizations with the 501(c)(3) designation, as the balance of their loans after 10 years of public service would be cancelled.

Since student loan repayment programs are quite technical, readers and borrowers are advised to seek help if needed to make sure that they are in the right program. While borrowers have a grace period of 6 months after graduation to begin repayment, they should undertake an evaluation of their total loans during the grace period and select the right loan servicer to service the repayment. If a borrower has taken out different kinds of loans, he should also consider whether to consolidate them to get the best interest rate possible. Contact Plenaris Advisory® for resources on student loans repayment.

- Mortgage Loans

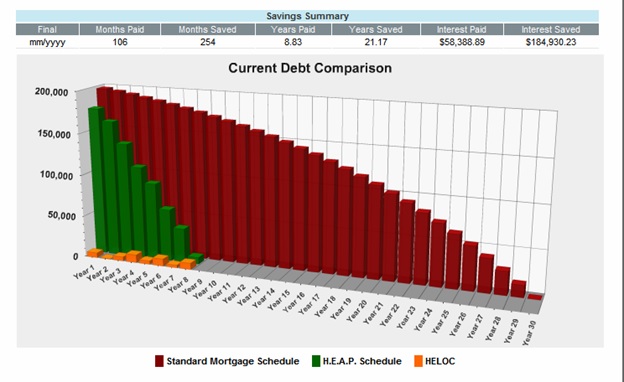

Mortgage loans normally take 30 years to amortize, though there are shorter terms like 15-year loan to accelerate pay-off. Plenaris Advisory® has a program that pays off a 30-year mortgage years early without impacting your lifestyle, provided there is surplus income available to accelerate the repayment.

Below is a graphic illustration of how it works. Instead of paying off the mortgage in 30 years, it can be paid off in 8 years. The strategy is to use a Home Equity Line of Credit (HELOC) to access the equity of a home and rapidly pay off the first mortgage. The HELOC is used as a checking account in place of a regular checking account that does not collect interest. Paychecks from work are directly deposited into the HELOC, which has a line of credit of $25,000. The loan payment is structured in the following way.

- The mortgage loan balance is $200,000 with monthly payment of $1231.43.

- The loan has 30 year to go.

- The borrower has a monthly income of $5000 payable every 2 weeks.

- Monthly expenses total $2450.

- Mortgage payment and monthly expenses combined total $3681.43.

- There is an excess cash flow of $1318.57, which will be employed to pay down the mortgage.

- A $25,000 line of credit is established in the HELOC.

- A $15,000 reserve amount is kept in the HELOC as emergency fund.

- The equity line has a 7.5% interest rate. This interest rate has negligible impact on the repayment program as the equity line is continuously replenished with deposits from the pay checks.

- The borrower deposits the $2500 paycheck every 2 weeks into the HELOC.

- The borrower immediately withdraws $10,000 from the HELOC and applies it to the $200,000 loan balance as prepayment.

- $3681.43 was also withdrawn from the HELOC to pay for all living expenses and the regular $1231.43 mortgage payment.

- All paychecks deposited into the HELOC operate to replenish all withdrawals.

- When the balance in the HELOC recovers the $10,000 prepayment withdrawn earlier to pay down the first mortgage, the borrower will withdraw another $10,000 to pay down the first mortgage.

- It would take 6 months for each $10,000 excess payment to complete one prepayment cycle until the mortgage is repaid in 8 years and 7 months for a savings of $177,518.69 in interest over the life of the loan.

Mortgage Pay-off Acceleration with HELOC

- Follow Good Money Management Practices.

There is no shortage of advice on how you should manage your money. But there are a few good money management practices that have stood the test of time.

- Save early and save often.

Do you know what it takes to save a $1 million dollars?

If you saved $5,000 every year at age 25, it will take 35 years to reach $1 million at 8% growth when you are 60.

If you saved $10,000 every year at age 25, it will only take 27 years to reach $1 million when you are 52.

If you do not start savings until later, achieving the $1 million goal will take from age 35 to age 70, and age 40 to age 75. It means that if you rely on your savings for retirement, you may not reach your goal until much later in life.

In order to make up for the late start, you will need to increase your savings in later year to achieve the same goal of reaching $1 million. While saving $1 million is not necessarily everyone’s goal, ‘save early and often’ is nevertheless a money management principle that would serve everybody well.

- Pay yourself first.

Pay yourself first ensures that you will save first before spending your money. It is the opposite of saving only the leftovers after you have done all the spending, which leads to inconsistent savings or saving nothing at all. This is why it’s important to participate in your employer’s retirement plans, as your contributions will be automatically deducted from your salary before you get your paycheck.

- Live within your means

This is a corollary to ‘save early save often’ as well as ‘pay yourself first.’ It requires that you only spend what you have after putting away your savings. Living beyond your means would lead to credit card debt and other money issues that may impact your life negatively.

‘Rich people stay rich by living like they are broke, and broke people stay broke by living like they are rich’ is another saying that illustrates the importance of living within your means.

- Use a budget to track your money

As we consider ‘know your numbers’ being the most important thing about money management, a budget is simply an organized way of knowing your numbers. Setting up a budget amounts to “telling your money where to go instead of wondering where it went,” as Dave Ramsey, a money management advisor, has stated on controlling your money. While many people consider a budget restricting and time consuming, it is the basis for developing a close relationship with your money by knowing how you have been treating it. Similar to any relationship, if you respect your money and are careful with it, it will take good care of you. If you are casual with money and spend it thoughtlessly, it may not want to stick around with you.

- A Journey of a Thousand Miles Begins with a Single Step

Managing your money sometimes can feel overwhelming, and the end game seems to be far, far away in years. It may take some time, yet anyone can achieve the goal of saving and becoming financially secure if one persists at it. If there is a problem of taking the first step, Plenaris is there to help you prepare your journey. Please take the first step by contacting us at plenarisadvisory@gmail.com, or call 408-293-1888.