Retirement Planning

- 20-30 Year Retirement

- The Risk Of Relying On Social Security

- Social Security Is Bedrock Of Retirement Income

- 10-12%+ Guaranteed Lifetime Income On Retirement Savings

- Tax-free Retirement Income

- Moderate Investment Risk During Retirement Years

- Match Your Income To Your Budget

- Healthcare Is A Major Budget Item

- Long Term Care

- Don’t Forget About Taxes

- Are You Asking these Questions About Retirement?

- Strategies For A Successful Retirement

- 20-30 Year Retirement

Americans generally retire between 60 and 70 when social security, pensions and Medicare kick in and the retirees would have some form of guaranteed income and health care that replace what they have had from their jobs. According to the 2017 National Vital Statistics Report, a division of the Centers for Disease Control and Prevention (CDC), the life expectancy for a male at 65 is 83 years, and 85.6 for a female. The Social Security Administration estimates that there is a 33% chance that a 65 year old would live to 90, and 14% chance of living to 95.

It means that if retirement starts at age 65, a retiree must have enough retirement resources to last 20 to 30 years. So, a major question with retirement is whether there is enough income to sustain a long retirement. The answer to the question is to ensure that a retiree will have lifetime income that he/she will not outlive. To date, only social security and company or public pensions offer lifetime income guarantees. Since only about 16% of employers still offer pensions, social security has become the only lifetime income available to millions of retirees.

In a recent Gallup poll of current retirees and non-retirees, 90% of retirees reported that they lean on social security as a source of retirement income, and 83% of the non-retirees indicated the same. This reliance on social security for retirement income is a record high. Yet, according to the Social Security Administration, the benefit is vulnerable to be reduced by as much as 23% by 2035 if the system does not improve its funding. Any reduction in social security benefit will call into question whether retirees will have enough income to last their retirement

- The Risk of Relying On Social Security

Besides the risk of benefit reduction in the future, many retirees are vulnerable to having their benefits reduced today. The reasons for benefit reduction include the following.

- Early benefit claim. If retirees claim benefits between age 62 and their full retirement age, which is based on their birthdate, their benefits can be reduced by as much as 25% permanently.

- Windfall Elimination Provision (WEP). If retirees receive a pension for their retirement from their employer, their social security benefits can be reduced by as much as 50%, depending on how long they have participated in social security. However, the reduction does not apply to spousal or survivor benefits.

- Government Pension Offset (GPO). If retirees receive a pension from a public employer and are also eligible for social security spousal or survivor benefit, their benefit would also be reduced by two-thirds or may be eliminated altogether if their pension benefits exceed the reduced social security benefit.

- Social Security is still the Bedrock of Retirement Income

Given the potential for benefit reduction, it is critical for retirees to be proactive prior to retirement in order to ensure that they will get the appropriate social security benefits applicable to their individual situation. As social security provides generally 40% of retirement income, here are a few issues that you need to take note when planning for retirement income.

- Benefit timing

Countless articles have discussed the merits of delaying benefit claim to age 70, though about 40% of beneficiaries elect to start benefits at 62, and nearly 70% begin benefits before their full retirement age. There are many considerations to benefit timing, which include whether a beneficiary needs the income due to job loss, health conditions, life expectancy, and the availability of other incomes. So the timing of benefit can be highly individualized. The critical issue is that claiming early can result in a permanent reduction in benefits. For example, if a person is eligible for a $2000 monthly benefit at age 66, starting benefit at age 62 will incur a 25% reduction of $500 monthly and $6000 annually. Conversely, waiting to start benefit at age 70 will result in a permanent gain of 32%, which translates to $640 more per month and $7680 per year. The difference in benefits can be significant over the lifetime of the beneficiary.

- Coordination of benefits between married couples

Though social security benefits are based on an individual’s work and earnings history, there are many ways that married couples can coordinate their respective benefits to maximize their aggregate benefits through spousal and survivor provisions. It is therefore advisable for beneficiaries to develop a social security benefit plan prior to retirement and prior to applying for any benefit.

- Special considerations for divorced individuals

Social security provides for spousal benefits for divorced individuals, provided they have been married for at least 10 years, must be 62 years old and unmarried at the time of benefits. The benefit is based on the former spouse’s benefit accounts, and is available even if the former spouse has not filed for benefits. However, the former spouse must be eligible for social security benefits in order for the divorced spouse to be eligible for spousal benefits.

- Social security benefits are subject to income tax

Income tax applies to social security benefits if the applicable income threshold exceeds $25,000 for a single filer and $32,000 for joint filers. The taxable amount is 50% of the benefit for income between $25,000 and $34,000 for single filers, and $32,000 to $44,000 for joint filers. For income that exceeds $34,000 for singles and $44,000 for joint filers, the tax would apply to 85% of the total benefits.

Because the benefits are subject to income tax, the Social Security Administration provides for tax withholding services at the beneficiary’s request.

- Receiving benefits while working

If a beneficiary receives social security benefit while working, his benefit will be subject to the earnings test, which amounts to having a portion of his benefit being withheld from payment. For 2019, if a beneficiary earns more than $17,640 per year, his benefit would lose $1 for every $2 earned above that amount. The test applies to earnings until the full retirement age of 66. A special earnings test applies during the year the beneficiary achieves full retirement age, in which event his benefit would lose $1 for every $3 earned above $46,920. All benefits withheld will be returned in the form of higher benefits in later years. The earnings limit for the test is indexed to inflation every year. So it is important for the beneficiary to be aware of the annual changes to the earnings test.

- Medicare premium paid out of social security benefit

Besides withholding for income tax, and earnings reduction, social security benefits payments are also reduced by Medicare premium if a beneficiary is also eligible for Medicare. It is therefore necessary for a retiree to be aware of exactly how much net payment he would get from social security on a monthly basis in order to plan for his retirement spending.

- 10-12%+ Guaranteed Lifetime Income On Retirement Savings

If you can transform your retirement savings into lifetime guaranteed income for a 10-12% or more payout, would you take it?

Plenaris Advisory® published a study recently that shows that annuities are a viable complement to social security for lifetime income. ( https://www.fa-mag.com/news/optimizing-annuity-income-benefits-a-case-study-45333.html.) This finding is by no means new, as countless studies have come to the same conclusion that using annuities for retirement income will enable retirees’ savings to last longer. But the unique finding of this study is that some annuities can provide an income that is based on a 10-12% or more guaranteed return on the retiree’s savings with no risk and no loss of the investment. Further, by allocating a significant amount of savings to annuities, retirees will have the certainty of having sufficient income to age 100 and beyond, as well as maintaining their lifestyle.

Guaranteed income vehicles such as annuity do not enjoy the full support of many financial advisors, particularly those who focus on stocks and bonds as their professional expertise, and who consider annuities as bad investments. However, given the volatility of the market and the persistently low interest rates, many retirees have reconsidered the merits of annuities as they realize that they may not be able to rely on stocks and bonds for retirement income due to the high risk of loss and uncertainty.

In fact, annuities have had a positive effect on the experience of many retirees. In a recent study on lifetime income, it was found that “. . . among those who report owning a guaranteed lifetime income product, 63% reported being highly satisfied with the purchase. Peace of mind was the most cited benefit. Three-quarters (73%) said the product is highly important to their financial security.” http://greenwaldresearch.com/wp-content/uploads/2018/03/2018-GLIS-Factsheet.pdf Such results are supported by numerous research, including a study undertaken by the RAND Corporation that found that retirees with annuities were 24.1% happier than those who did not have guaranteed income such as annuities. https://www.rand.org/content/dam/rand/pubs/drafts/2008/DRU3021.pdf.

For information on 10-12% guaranteed income on retirement savings, please contact plenarisadvisory@gmail.com.

- Tax-Free Retirement Income

Besides Roth IRA and municipal bonds, which are tax-free vehicles for retirement savings, cash value life insurance is the only other savings vehicle that would provide tax-free retirement income.

Cash value life insurance is permanent life insurance that allows tax-deferred growth of savings inside a policy and tax-free payout for retirement income purposes. Unlike traditional cash value life insurance such as whole life, there are many new cash value life insurance products that share the following characteristics.

- They can be custom-designed to meet a retiree’s needs.

- They can achieve a 5-6%, internal rate of return, tax-free.

- They offer downside protection against market downturns if the policy participates in market performance for growth, as the return for any year with a market downturn would register 0 instead of going negative.

- They offer living benefits that allow policyholders to access death benefits for long term care.

- The cash value of any policy is available and accessible for emergency or other purposes. You’ll never need a hardship distribution from your 401(k) plan.

- They can be structured to provide lifetime guaranteed income tax-free, which reduces longevity risks.

With regard to retirement planning, such cash value life insurance offers diversification of income streams and should be considered part of the retirement income portfolio.

Many people believe that cash value life insurance is too expensive, as compared with term life insurance. Plenaris Advisory® published a position paper on the cost of such life insurance, which shows that the common belief is unfounded, as the benefits of cash value life insurance can exceed comparable investments. Click the link for the position paper. https://www.fa-mag.com/news/is-permanent-life-insurance-too-expensive-41463.html?

Plenaris Advisory® is a partner with many of the top cash value life insurance companies that offer policies for retirement income. Contact us by email for information plenarisadvisory@gmail.com or call 408-293-1888.

- Moderate Investment Risk During Retirement Years

Investment risk is often tied to investment time horizon. If you are in your 20’s and 40’s, you can take on more risk as there is time for you to recover from losses. If you are in retirement or near retirement and you need to live on your savings, you may not be able to maintain the same level of risk as you did in earlier days.

If you have done the questionnaire on your personal investment risk score, you would know what your risk score is. If you have not done the questionnaire, click here.

The risk score from the questionnaire is a composite score for both risk tolerance and risk capacity. Risk tolerance is how you feel about risk. It is a subjective measure of how much risk you are willing to take on your investments and savings. Risk capacity denotes your ability to take on risk. The older you are, the lower your risk capacity because you may not be able to recover from losses due to the limited time you have to replace any loss of your retirement savings.

- Do you know the risk of your savings portfolio?

The task at hand for retirement planning is to match your risk score with the right kind of investment. For example, the risk score for the S &P 500 ETF SPY has a risk score of 62, and the risk score for a 60/40 equity/bond portfolio is 66. If your own risk score is 40, and if you have these investments in your portfolio, the implication is that your investment may have a higher risk than it should be.

If you would like to check out the risk score of some of your investments, click here. If you have any question about your portfolio and how to adjust it to match your risk tolerance and capacity, please contact us at plenarisadvisory@gmail.com.

- Match your income to your budget

The only way to ensure that you will have enough income for retirement is to match your income to your budget. Once you have a solid retirement budget, you will be able to devise an income plan with your savings. As our research has shown that budgeting is the first thing that needs to be done to control your cash flow, and to ascertain if you have enough savings for a long retirement.

- Healthcare as a major budget item

Similar to the issues covered in the segment on Money Management, setting up a spending budget in retirement is just as important as always, as you need to make sure that you have enough income to cover all the necessary spending. While you are expected to have a good understanding of various expenses, such as essential items like utilities, transportation, and housing, one expense that concerns most retirees is the cost of health care, which you must pay out of pocket now that you are no longer covered by an employer plan.

The basic health care plan for retirees is Medicare, which is available to all retirees at age 65. All eligible retirees are expected to enroll within 90 days of turning 65, unless they are still working and are covered by ‘creditable’ healthcare plans offered by their employers. Otherwise, any delay in enrolling in the program will be subject to a penalty that amounts to 10% surcharge over the applicable premium for every 12 months of the delay. So if the delay involves 36 months, the penalty will be 30% for as long as the retiree is enrolled in Medicare. To date, there is no maximum penalty.

As Medicare essentially covers only 80% of the cost incurred in a retiree’s health care expense, most retirees need to buy Medicap policies to cover the costs not covered by Medicare, which include various deductibles and co-pays. Medicap policies have been standardized in terms of coverage, but they can vary widely in cost. Additionally, the Medicare program also offers a Medicare Part C alternative, which is known as Medicare Advantage. Medicare Advantage plans are considered to be more cost effective as they are essentially one-stop care providers with well-defined services and cost structures.

There have been many studies on the potential cost of health care for retirees. The estimates have ranged from $285,000 for a couple retiring at 65 that include the basic Medicare and related expenses (https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/press-release/healthcare-price-check-040219.pdf.), to $405,253 that include expenses on dental, vision, deductibles, and copays not covered by Medicare (Source: Healthview Services Retirement Healthcare Costs Data Report 2018.) All these estimates assume that the retirees would have a retirement that spans 20 to 25 years. While the aggregate costs are large, the average cost over time would probably be around $15,000 to $20,000 per year in today’s dollars.

Note that these estimates relate only to the basic health care costs, and do not include long term care that is covered in another section of this website.

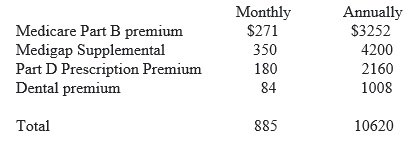

Are these estimates realistic? Here is a sample of the health care costs for 2019 for a retired couple with an annual income of around $150,000 who has elected the regular Medigap supplemental plan F. The costs may vary among retirees according to their elections, such as choosing a Medicare Advantage plan instead of a Medigap supplemental plan. There is also a wide variety of Part D prescription plans with different levels of deductibles and copays. The cost sample below includes dental insurance which many retirees may choose to forego.

Note that these costs pertain to premiums alone. There are deductibles, copays, and other out of pocket costs that are in addition to these premium payments. Note further that these are actual costs and are not estimates.

As Medicare Part B premium is based on the adjusted gross income of the tax return, it can range from the baseline of $135.50 per person per month to as much as $460.50 for income exceeding $500,000 for a single filing and $750,000 for a joint filing. It is expected that Medicare premium will continue to increase in order to maintain an adequate funding for the program.

Given the cost of healthcare, it is critical that all retirement plans provide for a realistic budget item for such cost. Then we also need to consider long term care.

- Long term care

Long term care (LTC) is defined as caring for a person who is unable to do activities of daily living such as eating, bathing, dressing, toileting, maintaining continence, and getting in and out of bed due to chronic illness. The care can last for a long time and sometimes requires a 24/7 care regiment, which explains why many patients end up in nursing homes where skilled nursing services are available.

There is a common belief that Medicare would pay for long term care. It is not true. Medicare would pay only for short term care that lasts about 100 days after hospitalization. All remaining care would be the responsibility of the patient and his/her family.

There are many issues regarding long term care. Plenaris Advisory® wrote a prima on long term care in 2010 that addressed many of the issues. Click here for the paper. All of the issues still apply today as the need for long term care remains critical. According to the U.S. Department of Health and Human Services, 70% of Americans who reach age 65 will require long term care services at some point of their lives. Yet a recent report by the U.S. Treasury Department found that only 12% of the over 65 population is covered by long term care insurance.

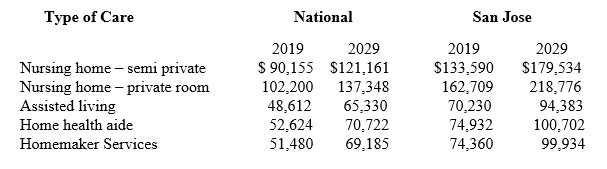

Why is long term care insurance important? It is because the cost for long term care can be catastrophic, and can drive anyone into bankruptcy without being prepared for it. Getting LTC insurance is a way to transfer the risk to insurance companies. Below is a chart of the cost for long term care for various care categories in 2019 and in 10 years. The data are derived from Genworth Financial, which conducts a national survey of long term care costs every year.

Annual Cost of Care, 2019 and 2029

Not only are patients that need LTC facing catastrophic expenses, more than 50% of insurance companies have abandoned their long term care insurance programs since 2012 because LTC expenses have exceeded what they had anticipated for their customers. Insurance companies that remain in business have received state approval for premium increases that can double the initial contractual amount, while at the same time reducing the benefits originally promised.

Today, the LTC landscape has actually improved as many insurance companies offer policies that are more flexible and friendly to consumers. Unlike the traditional policies that operate on the principle of ‘use it or lose it,’ many new policies offer return of premium if the insured does not end up using the benefits, or provide beneficiaries the balance of the benefits if the insured has not consumed all of it.

Given the cost of long term care, it is advisable to consider what each family can do to prepare for it by addressing the following issues.

- Do you have an estimate what your exposure to long term care will be?

- When will you need LTC?

- How long will you need it?

- How will you pay for it when you need it?

- Do you have any LTC insurance?

- Is it the right kind of LTC insurance?

- Did you know that many kinds of LTC insurance are available on the market at a variety of cost?

- Did you know that LTC premiums and benefits can be tax deductible?

- Did you know that you can use IRA funds for LTC premiums?

Plenaris Advisory® can help you address your LTC needs, and we have access to the best LTC policies available. Please contact us at plenarisadvisory@gmail.com, or call 408-293-1888.

- Don’t forget about taxes

As taxes can easily constitute 25% of one’s income, all budget planning must include it as a major item. Many retirees find that their tax obligation in retirement is the same or even higher than when they were working, as there are fewer deductions, particularly where there are no more deductions for retirement savings. In anticipation of the potentially higher tax liability, pre-retirees should utilize tools that will operate to reduce their future taxes, such as Roth IRA conversion and incorporating tax-free income sources.

- Are you asking these questions about retirement?

Here is a list of the most common concerns of retirees and pre-retirees about retirement.

- Do I have enough to retire?

- How much can we spend in retirement?

- Am I going to run out of money before I die?

- I’m retiring soon, what do we have to do with our portfolio?

- Will I have saved enough money to maintain my lifestyle in retirement?

- How much do I need to save for retirement?

- Should I buy an annuity?

- Should I take a lump sum distribution from my pension or annuitize it?

- Am I on track?

- When can I retire?

- Should I stay put or move?

- When should I begin taking social security?

- How do I sign up for Medicare?

- What does Medicare cover?

- Does Medicare pay for long term care?

- Should I get long term care insurance? . . .

If you have any of these concerns, please contact us and we will address these concerns to your satisfaction.

- Strategies for a Successful Retirement

We have put together some strategies for a successful retirement in a position paper. Click here for the paper. The main issue is clearly that you need to take charge and be engaged in your own retirement. Your retirement is too important not to be managed with the greatest care. Plenaris Advisory® is prepared to work with you on your retirement plan. Please contact us.